Community Banks

Mobile Banking

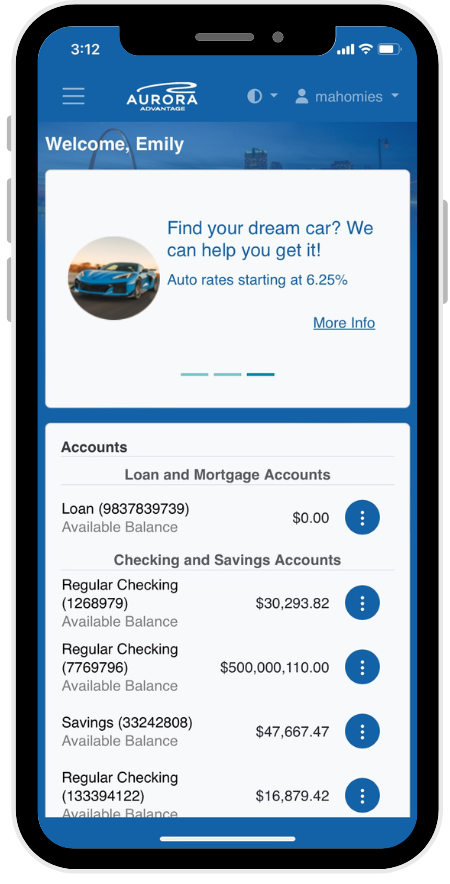

Our Mobile Banking Platform Provides Key Benefits:

- Provide 24/7 banking on-the-go

- Strengthens customer relationships

- Attracts new customers

- Expands bank delivery channels & customer contact

- Offers convenient financial management capabilities

- Provides low cost high volume delivery channel

Banking that Moves with You

Mobile phones have become the new front door to banking. Customers—especially younger generations and high‑value prospects—expect their financial institution to meet them in the moment, on the device they use for everything else in life. Convenience, speed, and intuitive digital access now define loyalty and influence where people choose to keep their money.

CSPI’s Aurora Mobile Banking positions your institution at the center of this shift. It delivers the seamless, modern mobile experience customers crave, helping you stay competitive, strengthen relationships, and ensure your bank is always within reach—right in the palm of their hand.

With Aurora, your bank becomes the one customers carry with them—always accessible, always secure and real-time, always relevant.

Enhance the Digital Experience with our Full-featured System

Customers will have the ability to:

- Securely view account information, statements and item images

- Upload remote mobile deposits saving your customers both time and money

- Schedule and view bill payments including P2P integration

- Initiate account transfers and loan payments

- Enable account preferences for quick balance and fingerprint/facial recognition

- Reset password

- Utilize new card management features to help prevent and monitor fraudulent debit card activity.

Other services include:

- GPS based branch and ATM locator

- Receive alerts and secure messages

- Bank directory with support contacts including email and telephone links

- Shortcut to access your FI’s bank website

- Quick calculators

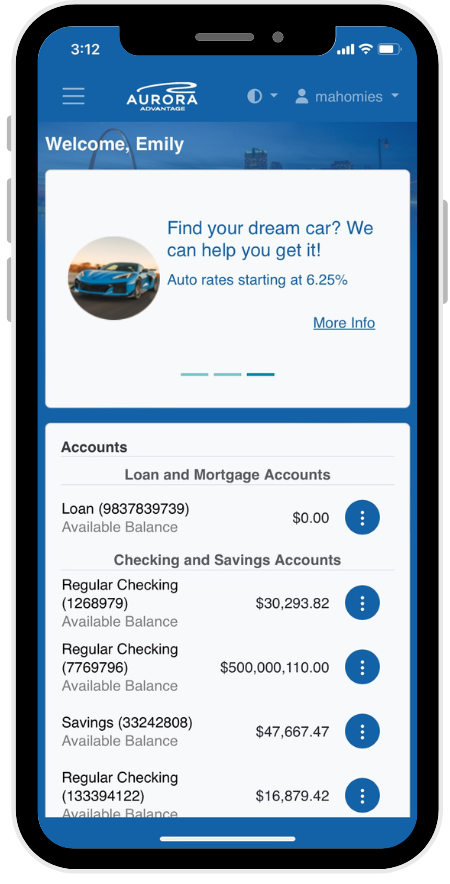

A Simplified, Personalized, and Connected Digital Banking Experience

Aurora delivers a true omnichannel experience for both retail and commercial customers, quietly connecting every touchpoint so users can move through their financial lives without interruption.

Whether account holders check their balance on an iPhone, approve a payment from an Android tablet, or log in through a browser, Aurora ensures the experience feels consistent, intuitive, and feature‑rich across every device. Behind the scenes, the platform works continuously to provide seamless access and dependable functionality, making everyday and business banking feel effortless.

With full branding capabilities, Aurora becomes a natural extension of your institution—reinforcing a cohesive identity and familiar experience at every digital interaction. Customers enjoy a unified, modern journey that adapts to their needs, while your institution benefits from a powerful, connected platform built to support the evolving demands of modern digital banking.

Native Mobile Applications

Integrated eBanking

Deposit Checks in a Snap

In every community, people are constantly on the move—running businesses, raising families, juggling responsibilities. Stopping by the branch to deposit a check isn’t always convenient, and customers increasingly expect their bank to fit seamlessly into their day, not the other way around. That’s where Aurora Mobile Remote Deposit Capture (MRDC) transforms the experience.

Aurora MRDC extends the power of traditional remote deposit right into your customers’ hands. Whether they’re using an iPhone, Android device, or tablet, they can securely deposit paper checks anytime, anywhere—between meetings, after hours, or from the comfort of home. For retail and commercial customers alike, it’s a simple tap-and-snap process that turns a once‑in‑person task into a moment of effortless convenience.

For community banks, this isn’t just a feature—it’s a way to stay connected to the people you serve. Aurora MRDC strengthens relationships by giving customers the freedom to bank on their terms, while reinforcing your institution’s commitment to modern, accessible, hometown service.

Your Money, Moving on Your Schedule with Seamless Bill Pay

Aurora Online Banking makes bill payment feel less like a chore and more like a natural part of your day. The platform brings every element of bill pay together from a single, streamlined dashboard, customers can create payees, schedule and manage payments, track what’s due, and even send P2P transactions—all in one place.

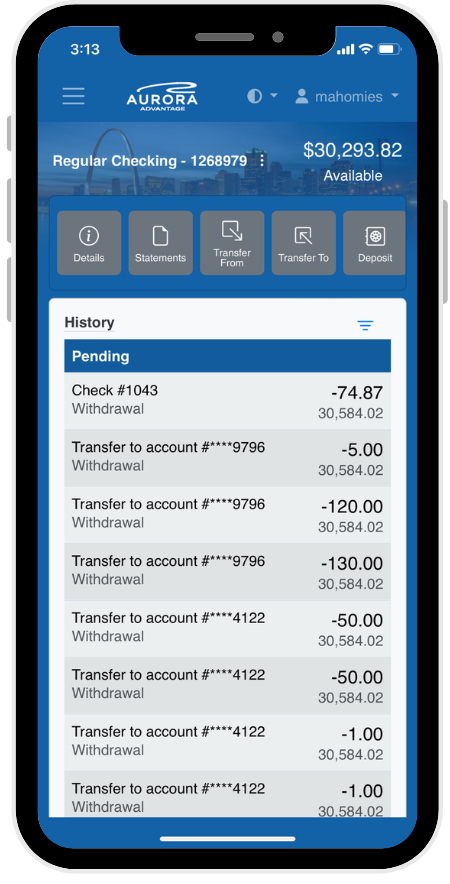

Real‑Time Debit Card Control Made Simple

Aurora’s Card Management tools put cardholders in charge of their security and spending. From the mobile app, users can easily register or activate their debit cards, adding an extra layer of protection against fraud. They can set real‑time alerts for card activity, instantly block or unblock transactions when the card isn’t in use, and even set travel alerts to ensure uninterrupted access while on the move. It’s proactive, customizable card control designed to keep customers confident and protected at every step.