What is Aurora Financial Analytics?

Aurora Financial Analytics (AFA) is designed to satisfy your CECL and IFRS-9 (International) reporting requirements. A ‘big data’ software solution that employs sophisticated but straightforward and well-accepted statistical techniques to quantify the risks and mathematically determine the expected losses in a consumer loan portfolio.

Why Choose Us?

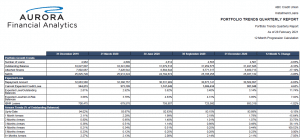

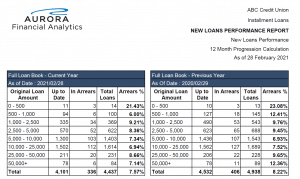

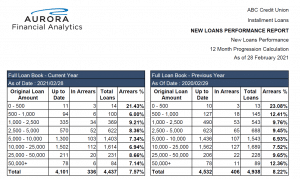

- Multi-layered reporting system gives you on-demand insights into your loan portfolio.

- Provides benefits to all departments: Board of Directors, CEO, Loan Officers, Collections, Financial Controller, etc.

- AFA allows you to forecast pricing decisions based on robust data that reflects actual performance of a loan.

Risk-Based Information to Make Better Loans

EVALUATE

RISK PROFILE

Determine the risk profile of every loan type based on your unique borrowing population

CALCULATE

RISK-BASED PRICING

Calculate optimal risk-based pricing given the variables included in the data set you provide to AFA

TRACK DELINQUENCY &

RECOVERY RATES

Track how changes to the credit scores and collateral values of your borrowers are trending and how that impacts your delinquency and recovery rates.

COMPUTE

LOSS PROVISIONS

Compute statistical starting points for determining expected loss provisions under FRS102/CECL/IFRS9

INFORM

UNDERWRITERS

Inform your loan underwriting to focus on loan approvals most likely to be good performers, avoiding those likely to fail.

CREATE

CUSTOM REPORTS

Create custom reports for responding to stakeholder queries to show exactly where there are risks in your portfolio and where you are likely to succeed.

How does it work?

Aurora Financial Analytics (AFA) is not an econometric-type model, nor is it based on any assumptions (i.e. guesses) as to future factors such as interest rates, employment statistics, GDP growth, or otherwise.

Instead, AFA applies mathematical and statistical techniques that are common practice in the insurance industry to objectively quantify risk and to forecast losses in a consumer loan portfolio. The analysis is based solely on the hard data mined from the client’s core IT system.

Unlike the other systems used for consumer loan risk analysis and provisioning, AFA computes the expected losses for loans that are not delinquent, along with incurred-but-not-reported (IBNR) losses that, in fact, have already impaired the actual value of the portfolio.

Virtually every ‘bad loan’ starts out as a ‘good loan’ that is not in arrears during the first month or so of its existence, and perhaps for many months more. The question AFA answers is how much loss can be anticipated from loans that are not (yet) in arrears, as well as from those that are.

AFA therefore responds to a practical reality that is inherent in prudent consumer lending: Assuming good underwriting, consumer loans typically go bad for reasons that were basically unforeseeable when the loan was made and that are unlikely to reach the lender’s attention until after the loan falls into arrears. Those include the borrower’s job loss, ill health or substance abuse problems, marital difficulties, and so on.

There is, of course, no practical way of knowing whether any particular good loan will become a bad loan for such reasons. However, by employing the ‘law of large numbers’ AFA performs an analysis of each lender’s experience to forecast the percentages of loan types that will go bad for whatever reason (and when that will happen), at the portfolio, sub-portfolio and micro-portfolio levels.

The forecast is derived from the actual credit performance of the particular community of borrowers served by the lender. Because the data is refreshed monthly, AFA quickly picks up new risk trends resulting from recent changes in the environment that will impact future delinquency and default experience.

Conceptually, AFA’s analysis is similar to the actuarial analysis that enables a life insurer to project how many 30-year-olds will die in a particular year, so that it can set its pricing and claims reserves accordingly, even for policies issued without a health examination. The insurer does so based on mortality tables that reflect the actual experience of the relevant population.

What departments will benefit from the data analysis?

- For the Board of Directors:

- Provides the means to objectively monitor and measure the CEO’s performance in managing the risks and opportunities of your lending business

- Supplies key lending metrics for effective board oversight of the single most significant source of income (and risk) for your CU.

- Provides facts to understand the actual credit risks in each of your CU’s loan portfolios, on a monthly updated basis.

- High-level oversight of effectiveness of collections and credit control functions

- Confidence of having a completely independent and objective means to monitor lending risk

- Key tool to foster and maintain appropriate governance process in which the board focuses on strategic direction, policy and monitoring results, so the CEO can manage the credit union

- For the CEO:

- Gives you in-depth insight into your loan portfolios that demonstrates to your board, auditors and regulator that you are on top of your game of managing your credit union’s lending.

- Gives you the critical lending risk numbers you need for board and regulatory reporting.

- Enables you to identify risk trends in credit quality.

- Highlights strengths and weaknesses in your credit control policies and practices.

- Tracks recovery rates on bad loans.

- Identifies your best and worst performing loan products.

- Gives you the insights you need to improve and price existing lending products and to design new ones.

- Gives you the insights you need to grow your lending portfolio.

- Objectively measures staff/branch performance in making loans that get repaid.

- Objectively computes the data needed for safe and accurate loan provisioning

- For the Head of Lending:

- Shows how well your underwriting practices are actually working to manage risk.

- Displays how well loans are performing by size, by type, by collateral, whether or not rescheduled, etc. – using the parameters you select.

- Calculates how well top-ups and other multiple loans to the same borrowers are performing.

- Helps you identify which loan types need more/less/different underwriting attention than you and your team are giving them.

- Allows you to easily drill down into the record of any borrower to see his/her payment and arrears history before you grant a new loan advance.

- Gives you the data to realistically know when loan restructuring is actually likely to result in repayment.

- Shows you which loan officers are generating good loans – and bad ones.

- Supplies the data you need for management reporting to the CEO.

- For the Head of Collections / Credit Control:

- Gives you a clear read on whether the arrears situation is improving or deteriorating and where.

- Spots the early arrears your team should address before they get worse.

- Tells you which loans are most likely to be collected and where you should focus your efforts.

- Measures the effectiveness of your collection activities.

- Shows how well your outside collection agencies are performing in reducing your losses and increasing your recoveries.

- Helps you identify which of your team’s practices are working and where your team can improve collections and reduce write-offs.

For the Whole Team:

Gives you a key tool for making more loans that are good loans and that build net income for your credit union.