What We Do

For 35+ years, CSPI has led the FinTech industry with innovative software and services for forward-thinking community banks and credit unions. Based in the Midwest, our reach extends nationwide and into the Caribbean.

Why CSPI

What Inspires Our Work

Our Vision

Partnering with financial institutions to accelerate their growth through superior service and transformative technology.

Our Core Values

Commitment, Service, Partnership, and Integrity guide everything we do.

Our Way of Working

Powered by a skilled team with clear and caring values, we work to streamline complexity and minimize challenges so community FIs can win.

Leading the Future of Community Banking

For over 35 years, CSPI has been at the forefront of the FinTech industry, providing unparalleled software and services tailored to the needs of progressive community banks and credit unions. Headquartered in the Midwest, our influence spans coast to coast in the United States, with an international presence in the Caribbean.

CSPI’s commitment to innovation is exemplified by our comprehensive Aurora Product Suite including core platform, online account opening, online and mobile banking, document management, item processing and managed IT services.

Just like our community banks and credit unions, we operate independently to cater to our clients’ needs. Our operations and strategic plans aren’t reliant on venture capital funding, granting us the freedom to chart our own path.

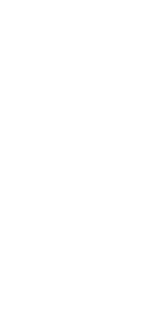

Technology That Works the Way You Do

At CSPI, we do more than deliver technology — we build partnerships focused on simplifying operations, unifying processes, measuring success, and amplifying the value you provide to your account holders. Every product we enhance or introduce is thoughtfully designed to reflect these core principles.

Our dedication to simplicity and integration is further reflected in our open architecture ecosystem. Through the use of APIs (Application Programming Interfaces), we enable seamless connectivity between our Aurora solutions and third-party platforms, giving you the freedom to choose the digital banking tools that best fit your institution.

Join us as we reshape the future of FinTech — where innovation is practical, collaboration is central, and success is a shared destination.

The CSPI Way: Exceeding Expectations

-

1988

CSPI Opens Doors

1992 Cold Report Writer -

1994

First Item Processing Customer

-

2006

Document Imaging & Tracking

-

2012

Acquired Online Banking & later developed our own Mobile Banking

-

2020

Acquired CruiseNet Core and rebranded to Aurora Advantage.

2021 migrated core to Microsoft Azure Cloud -

2023

New Product:

Aurora Launch Digital Account Opening Lending & Celebrating 35 Years

The CSPI Way: Exceeding Expectations

As our name implies, we deliver financial institutions professional service and solutions that go beyond expectations, backed by a dedicated US-based team offering expert, cost-effective guidance.

For over 35 years, our commitment to responsive support and continuous innovation has built lasting partnerships because your success drives ours.

-

1988

CSPI Opens Doors

1992 Cold Report Writer -

1994

First Item Processing Customer

-

2006

Document Imaging & Tracking

-

2012

Acquired Online Banking & later developed our own Mobile Banking

-

2020

Acquired CruiseNet Core and rebranded to Aurora Advantage.

2021 migrated core to Microsoft Azure Cloud -

2023

New Product:

Aurora Launch Digital Account Opening Lending & Celebrating 35 Years -

2024

New Custom Report Writer

-

2025

New Digital Banking Redesign & Joined the Embrace Software, Inc. Family.

Who We Are

We're here to celebrate all of

life's milestones...

At CSPI, we’re proud to be a place where people choose to build their careers —not because they have to, but because they want to. With an average tenure of 10 years, our team brings experience, heart, and a shared commitment to doing good work. We keep things professional but human, creating a space where ideas are heard, people are respected, and everyone has room to grow.

That consistency shows up in how we support our customers too—steady, reliable, and focused on getting things right. Around here, excellence isn’t a buzzword; it’s just how we show up for each other and for the financial institutions we serve.