Digital Banking Transformation Paradigm

February 11, 2021 | Blog

As digital banking became the primary source on the front line during the 2020 pandemic, many financial institutions (FI’s) craved digital banking transformation through product enhancements or new Fintech solutions to provide relief and convenience for their account holders while their lobbies remained closed.

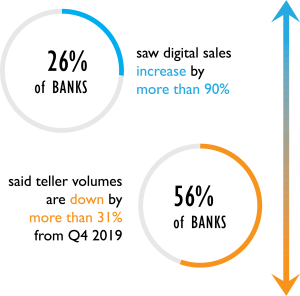

According to an analysis by Novantas in August of 2020, 56% of banks said teller volumes are down by more than 31% from Q4 in 2019, while 26% of banks saw digital sales increase by more than 90%! In fact, as online banking systems were flooded with record high usage during the dispersal of the first stimulus check, many industry wide outages of online banking were reported by big players. We are happy to announce that CSPI customers experienced 98.9% uptime. Throughout 2020, community banks and credit unions upheld their mission of serving their communities; instead of waiting out the pandemic, they recognized the opportunity to better serve their account holders and took action. These FI’s were nimble and acted quickly in effort to capitalize on their digital banking transformation.

Before we continue evaluating digital banking trends, lets ensure we understand the terminology. We’ll start by defining the original terms of internet or online banking which are sometimes improperly interchanged with digital banking. Online banking has revolutionized our relationship with financial institutions, as account holders no longer need to visit a physical branch to manage their everyday financial transactions. Online banking enables users to process core transactions via their laptop, desktop computer, or smartphone. While online banking focuses on digitizing the “core” aspects of banking, digital banking encompasses digitizing every program and activity undertaken by financial institutions and their customers. Digital banking involves high levels of process automation and web-based services that may include APIs enabling cross-institutional services to deliver banking products and provide transactions.

As products such as online banking continue evolving into more robust applications and processes, falling under the digital banking umbrella, the user experience is transformed. Throughout the pandemic, CSPI had the honor to assist numerous financial institutions with their digital banking transformation. Below are a few trends our team noticed within our Aurora Online and Digital Banking platform:

• While many believed voice banking was a product of the past, FI’s received a large influx in call volumes as account holders awaited their stimulus checks to be deposited and kept a close eye monitoring their account balances throughout 2020.

• As the virus continued to spread, financial institutions closed lobbies and operated mostly from drive-thru facilities. Many FI’s opted to enhance their mobile banking offerings by adding modules such as mobile remote deposit (MRD). MRD not only added convenience for account holders to deposit a check from their mobile banking app utilizing their mobile device, but also aided efforts to slow the spread while protecting the FI’s team members with less physical customer interaction.

• Another popular trend was adding bill payment modules such as eBills and person to person (P2P) transfers. Our seamless bill pay integration allows account holders to easily create payees, schedule and manage their payments all from a single screen, and incorporates P2P transactions.

• Incorporating card management services into mobile banking apps allowed cardholders to receive another layer of protection to prevent or quickly detect fraudulent activity by receiving custom alerts when your card is used and blocking transactions when the card is not in use. As fraudulent activity continues to rise, account holders appreciate having control of their debit card with only a few simple taps. Our clients saw a quicker adoption rate of the card management services once integrated with our mobile app as most account holders didn’t want to manage separate apps.

The bottom line is, financial institutions that quickly pivoted their focus towards digital banking transformation were rewarded by creating stickier account relations, and drawing the consumer closer. At CSPI, our team is always focused on enhancing the account holders experience. If your FI is seeking a digital banking transformation, please contact us! We would appreciate the opportunity to grow with you.