Credit Unions

Image Processing CU

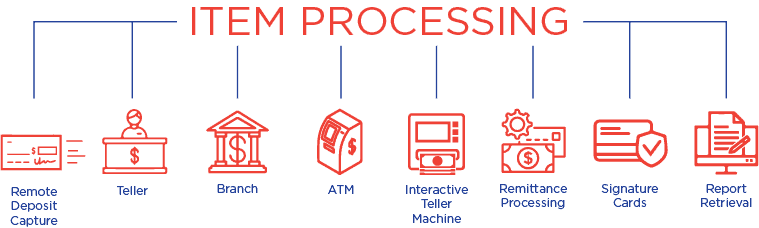

Item Processing

Make Every Employee a CSR

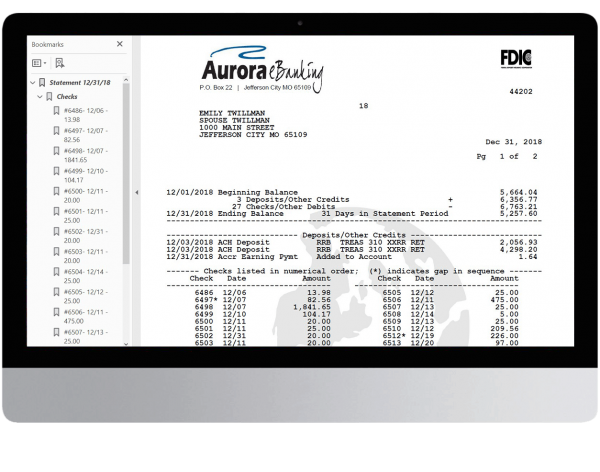

Our system is designed to make every bank employee a customer service rockstar! You have access to data as soon as it is captured and balanced. This means that all employees can research transactions captured just seconds ago; even before they’re transmitted to the core system. Has a loan payment been made? Was my deposit received today? What specific checks went with my deposit? Any of these customer questions can be answered with the click of a button.

Features of our software will give you a competitive advantage. With user-defined reports, review how many competitor checks come through your bank. These reports include end-point analysis information (i.e. which routing numbers receive most of your outgoing items). Numerous reports are provided and these reports can be modified at any time.

We design every module to interface with other non-CSPI systems. From retrieving customer information from your core system to passing images to internet banking products, we’ve made data exchange a seamless process.

Research

Check 21

Image Statements and Notices

Standard Reports

- Batch Balancing Report

- Branch Totals Report

- Cash Letter

- Deposit Analysis Report

- Duplicate Item Report

- End of Run/Day Totals

- Modified Item Pull

- Master Transaction Listing

- Reject Repair Journal

- Pocket Totals

- Selector Totals

User-Defined Reports

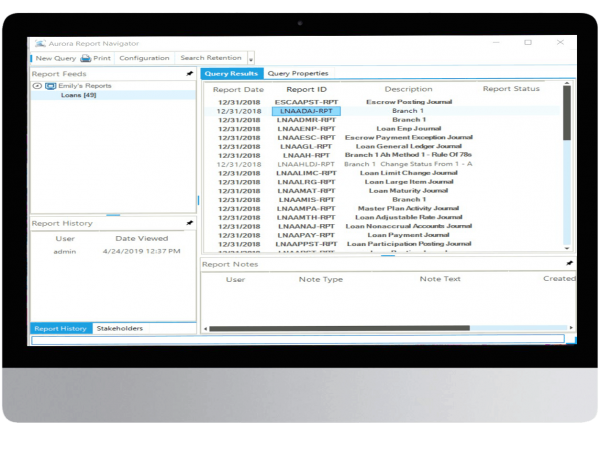

CSPI’s Image Processing system gives users the ability to create their own reports based on specific needs. The reports can be accessed at any time to retrieve required data. Examples include General Ledger, Teller Totals, High Dollar and Endpoint Analysis reports. Any report that lists individual items can be printed with their corresponding images.

Creating a User-Defined Report is simple and quick. A setup wizard walks the user through the process. Once created, reports can be copied and modified to become new reports. For example, a Teller Cash report can be created for Teller 1 and then copied for Tellers 2, 3 and so on. Each newly copied report only needs an account number or transaction code changed to match each teller.

Signature Cards

Report Retrieval

The Report Retrieval system automatically parses, categorizes and stores a myriad of reports generated by the core system, making them quick and easy to research. Report Retrieval is fully integrated with our Image Processing system and includes user security control. Users and rights are managed from one location for both systems.

The auto-store feature makes storing reports a completely unattended process. At pre-defined times throughout the day or night, the automated scheduler can run up to 26 individual, unattended stores. Now, instead of all the day’s reports being held up until the last one is generated, reports can be made available throughout the day as they are produced. Plus, processing for multiple institutions is more manageable since a single install of Report Retrieval can store reports from multiple core systems. Reports can be stored in multiple formats, such as text documents, Adobe PDF, MS Word and MS Excel.

Testimonials

What Our Customers Say

Trusted Partnership for Over 30 Years

We have done business with CSPI for 31 years and trust the relationship we have with them. We are a small bank with a great desire to serve our customers. CSPI is working hard to provide banks with features the next generation of customers want and need.

Trusted Partnership for Over 30 Years

We have done business with CSPI for 31 years and trust the relationship we have with them. We are a small bank with a great desire to serve our customers. CSPI is working hard to provide banks with features the next generation of customers want and need.

Trusted Partnership for Over 30 Years

We have done business with CSPI for 31 years and trust the relationship we have with them. We are a small bank with a great desire to serve our customers. CSPI is working hard to provide banks with features the next generation of customers want and need.

Trusted Partnership for Over 30 Years

We have done business with CSPI for 31 years and trust the relationship we have with them. We are a small bank with a great desire to serve our customers. CSPI is working hard to provide banks with features the next generation of customers want and need.